How Can I Invest in Gold? Investopedia

#0183;#32;Several ways exist to invest in gold: buying the metal itself, buying gold funds, or buying gold options. Investing in gold bullion for individuals takes the form of gold bars or coins. Mutual...

WhatsApp)

WhatsApp)

#0183;#32;Several ways exist to invest in gold: buying the metal itself, buying gold funds, or buying gold options. Investing in gold bullion for individuals takes the form of gold bars or coins. Mutual...

Evolution Mining Limited saw 40,863,991 trades on Tuesday and its share price rose by %. It is the largest of these 3 gold miners on the ASX 200. This is a very solid company with a fiscally

This week: Gold mining shares What do QE2, India and Goldman Sachs have in common? The answer is each has played a part in driving the already skyhigh price of gold to record levels.

The Solactive Global Pure Gold Miners Index tracks the price movements in shares of companies which are active in the gold mining industry. At least 90% of the companies'' revenues need to be generated by gold mining activities.

The answer depends partly on how you invest in gold, but a quick look at gold prices relative to stock prices during the bear market of the recession provides a telling example.

This week: Gold mining shares What do QE2, India and Goldman Sachs have in common? The answer is each has played a part in driving the already skyhigh price of gold to record levels.

Putting some gold into your portfolio doesnt mean you have to stash bullion bars or hide a cache of coins in the cellar. Many investors prefer to take an indirect approach and invest in the stock of gold mining companies. Here are some key points to consider when taking this approach: Gold mining stocks are easily bought and sold.

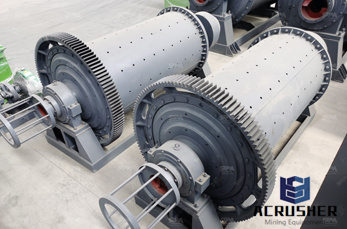

Investing in Gold Mining Companies

Latest Share Tips; How To Invest. Ten Steps To Financial Freedom Smarter, Happier, In the midcap area of the market, there are a number of companies that are engaged in the mining of gold.

Traded on the London Stock Exchanges junior AIM market, Scotgold shares are 54p and should shoot higher as the firm moves closer to selling its gold. Like many of our national mining projects

#0183;#32;Gold production for the second quarter was 412,315 oz. at an allin sustaining cost (AISC) of 953 per oz. Adjusted net income was million ( per share

#0183;#32;As an aspiring mining investor, you''re probably wondering whether you should invest in junior mining stocks or major mining stocks. The answer depends on what you are looking for.

How to Invest in Gold Mining Stocks From individual companies to exchangetraded funds, you can get the portfolio exposure to the precious metals industry that you want.

#0183;#32;Gold mining stocks are in the throes of their best stretches in nearly seven years as theyve hit their highest prices since 2013. If picking out specific gold mining companies to invest in seems a little daunting, take a look at the VanEck Vectors Gold Miners ETF (NYSE: GDX ).

#0183;#32;How to Invest in Gold Mining Stocks From individual companies to exchangetraded funds, you can get the portfolio exposure to the precious metals industry that you want.

Gold mining shares go up when everything goes down Between 8 January 2010, and 10 January 2010, the ASX 200 rose by around 41% in a nearly continuous upward trend.

#0183;#32;The answer depends partly on how you invest in gold, but a quick look at gold prices relative to stock prices during the bear market of the recession provides a telling example.

#0183;#32;Gold companies have little or no control over the pricing of their own product. They can only control costs to some extent. There is not a lot of institutional ownership in gold miners; its kind of the wild west with a lot of retail investors owning the shares. Gold mining is a small and fragmented industry, and management is not very good.

WhatsApp)

WhatsApp)